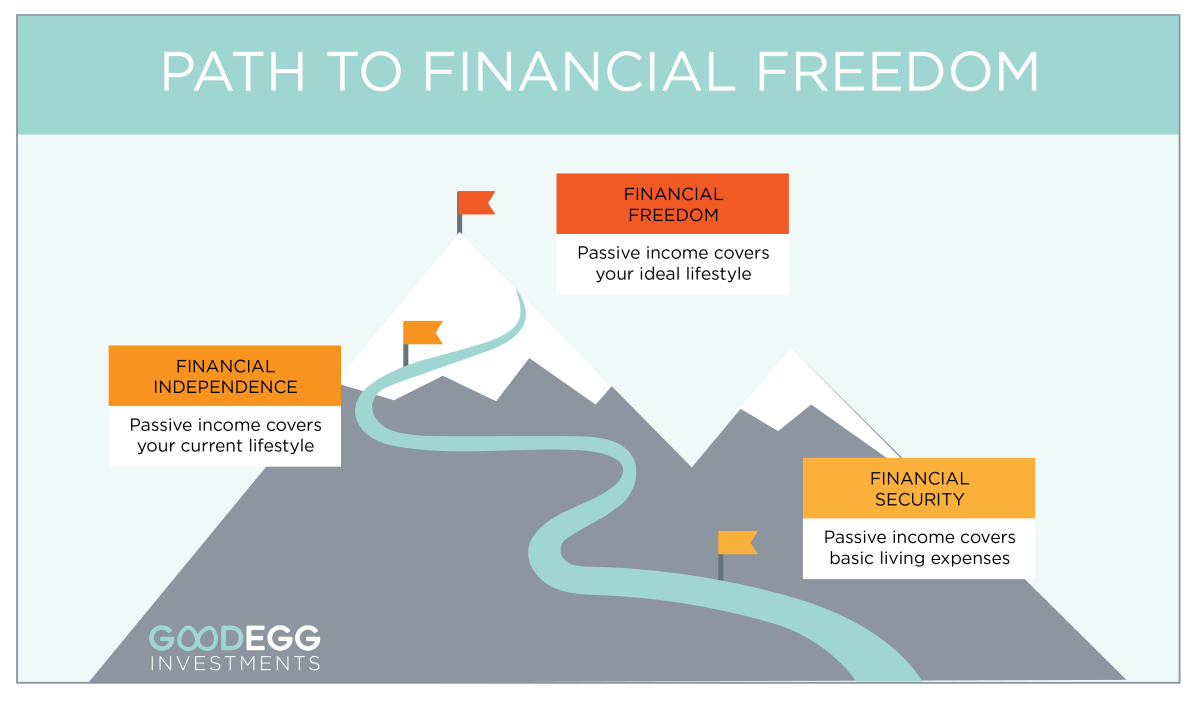

Financial independence is the state of having enough financial resources to live comfortably without relying on income from employment. It means having the freedom to pursue your passions, travel, or simply enjoy life without financial stress.

Key Components of Financial Independence

- Emergency Fund: A substantial emergency fund is essential to cover unexpected expenses without dipping into your long-term savings.

- Debt-Free Lifestyle: Aim to eliminate high-interest debt, such as credit card debt, to free up more of your income.

- Retirement Savings: Build a substantial retirement nest egg to ensure a comfortable retirement.

- Passive Income: Generate income from sources other than employment, such as rental properties, dividends, or investments.

- Minimalist Lifestyle: Consider adopting a minimalist lifestyle to reduce unnecessary expenses and increase your savings rate.

Strategies for Achieving Financial Independence

- Set Clear Goals: Define your financial goals, such as retiring early or achieving a specific net worth.

- Create a Budget: Track your income and expenses to identify areas where you can cut back.

- Increase Your Income: Explore ways to increase your income, such as starting a side hustle or asking for a raise.

- Invest Wisely: Invest your savings in a diversified portfolio of assets to grow your wealth over time.

- Automate Your Finances: Set up automatic contributions to savings and investment accounts to make saving effortless.

- Educate Yourself: Learn about personal finance concepts, investing, and money management.

Benefits of Financial Independence

- Freedom and Flexibility: Financial independence allows you to live life on your own terms and pursue your passions.

- Reduced Stress: Knowing that you have a financial safety net can significantly reduce stress and anxiety.

- Improved Quality of Life: Financial independence can lead to a higher quality of life, allowing you to enjoy experiences and travel opportunities.

- Generosity: Financial independence can give you the ability to help others and make a positive impact on the world.

Achieving financial independence is a journey that requires discipline, patience, and perseverance. By following these strategies and staying committed to your goals, you can create a financially secure future and live a life of freedom and fulfillment.