Foreign investment, also known as foreign direct investment (FDI), refers to the investment of assets by a company or individual in another country. It can take various forms, such as building new facilities, acquiring existing businesses, or investing in local securities.

Benefits of Foreign Investment

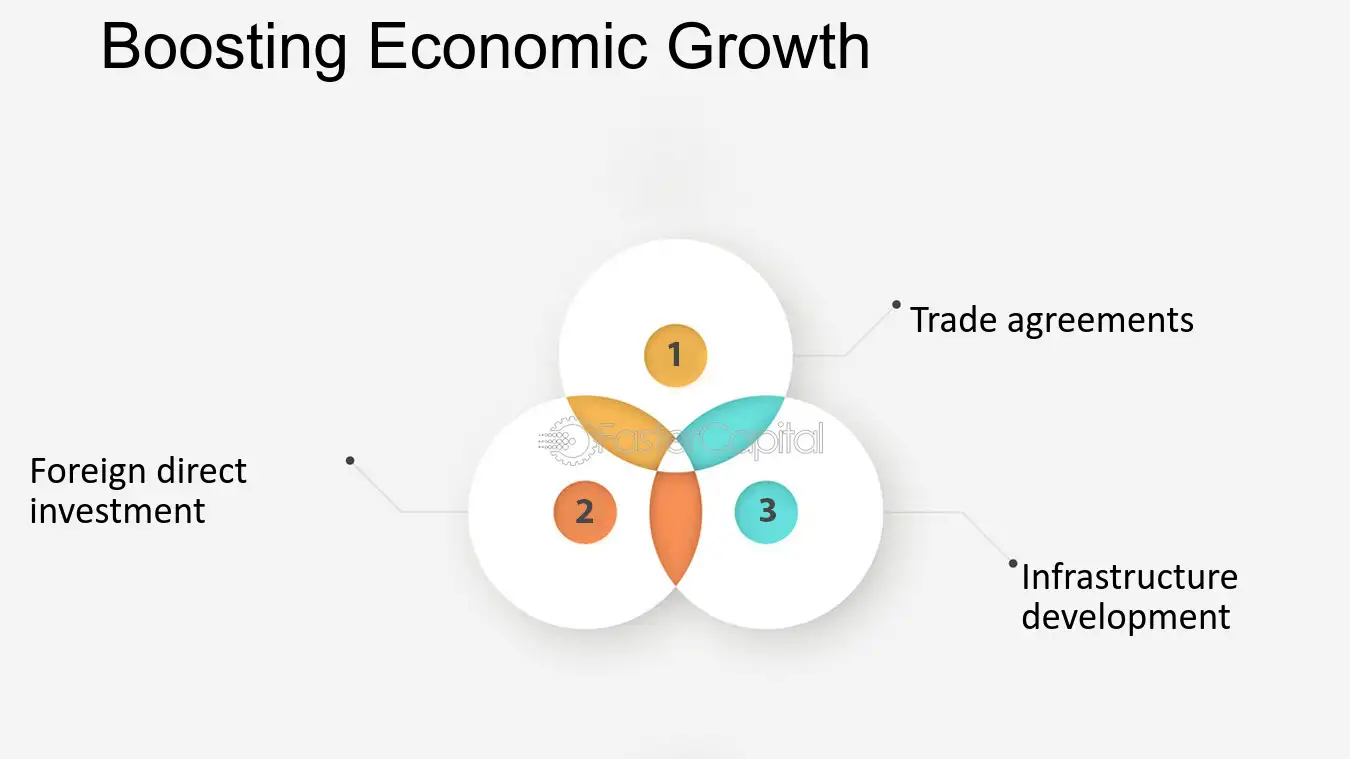

- Economic Growth: FDI can stimulate economic growth by creating jobs, increasing exports, and transferring technology and knowledge.

- Infrastructure Development: Foreign investors often contribute to the development of infrastructure, such as transportation networks and industrial parks.

- Increased Competition: FDI can increase competition, leading to lower prices, improved product quality, and greater consumer choice.

- Technology Transfer: Foreign investors can bring advanced technology and expertise to a country, fostering innovation and productivity.

- Market Access: FDI can provide companies with access to new markets and customer bases.

Factors Attracting Foreign Investment

Several factors can attract foreign investors to a country, including:

- Political Stability: A stable political environment is essential for foreign investors to feel confident in their investments.

- Economic Stability: A strong economy with low inflation and sustainable growth can be attractive to foreign investors.

- Infrastructure: Adequate infrastructure, such as transportation networks and energy supplies, is crucial for businesses to operate efficiently.

- Labor Market: A skilled and affordable workforce can be a significant advantage for foreign investors.

- Favorable Investment Climate: Tax incentives, regulatory frameworks, and intellectual property protection can create a favorable environment for foreign investment.

Challenges and Risks of Foreign Investment

- Cultural Differences: Foreign investors may face challenges in understanding and adapting to local cultural norms and business practices.

- Political Risks: Political instability, changes in government policies, or expropriation can pose risks to foreign investments.

- Economic Risks: Economic downturns, currency fluctuations, and inflation can impact the profitability of foreign investments.

- Regulatory Hurdles: Complex regulations and bureaucratic procedures can hinder foreign investment.

Strategies for Promoting Foreign Investment

Governments can implement various strategies to attract foreign investment, such as:

- Improving Infrastructure: Investing in transportation, energy, and telecommunications infrastructure can make a country more attractive to foreign investors.

- Creating a Favorable Business Environment: Simplifying regulatory procedures, reducing bureaucracy, and providing tax incentives can create a more welcoming environment for foreign investors.

- Promoting Export Opportunities: Supporting local businesses in developing export markets can increase the country’s attractiveness to foreign investors.

- Developing Human Capital: Investing in education and training can enhance the skills of the workforce and make the country more competitive.

- Promoting Foreign Investment Zones: Establishing special economic zones with favorable conditions for foreign investors can attract investment and spur economic development.

By understanding the benefits, challenges, and strategies related to foreign investment, governments and businesses can work together to promote economic growth and development.