Investment planning is a systematic approach to managing your finances and achieving your long-term financial goals. It involves setting clear objectives, diversifying your investments, and regularly reviewing and adjusting your portfolio.

Key Components of Investment Planning

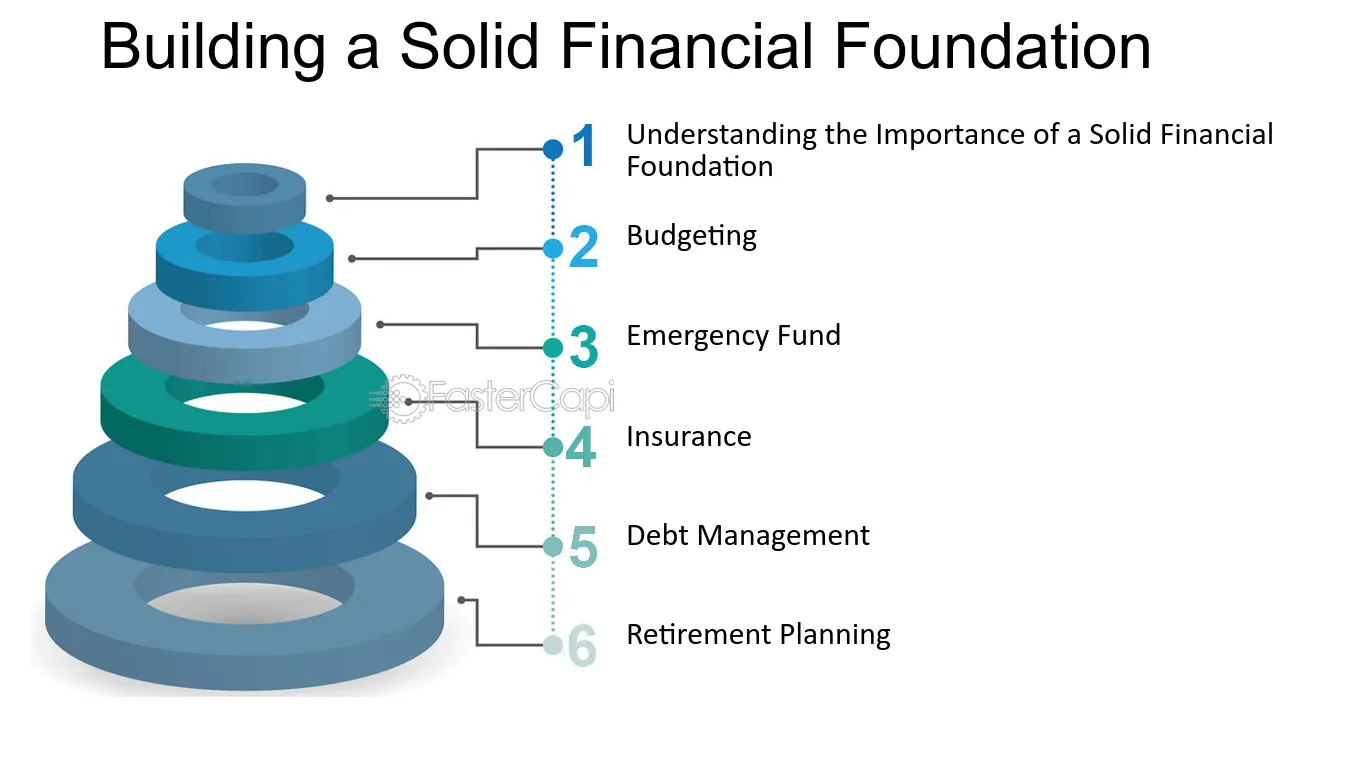

- Define Your Goals: Clearly outline your financial objectives, whether it’s saving for retirement, buying a home, funding your child’s education, or building an emergency fund. These goals will guide your investment strategy.

- Assess Your Risk Tolerance: Determine your comfort level with risk. This will help you choose investments that align with your personality and financial situation.

- Create a Budget: Develop a detailed budget to track your income and expenses. This will give you a better understanding of your financial situation and help you allocate funds towards your investment goals.

- Diversify Your Investments: Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and industries to reduce risk. Diversification helps protect your portfolio from market fluctuations.

- Consider Time Horizon: The length of time you have to invest is crucial. Long-term investors can generally afford to take on more risk for potentially higher returns, while short-term investors may prefer more conservative options.

- Review and Rebalance: Regularly review your investment portfolio to ensure it remains aligned with your goals and risk tolerance. Rebalance your portfolio as needed to maintain your desired asset allocation.

Common Investment Vehicles

- Stocks: Represent ownership in a company. They offer the potential for high returns but also carry higher risk.

- Bonds: Debt securities issued by governments or corporations. They generally offer lower returns than stocks but are less risky.

- Mutual Funds and ETFs: Pooled investments that allow you to invest in a diversified portfolio of stocks, bonds, or other assets.

- Real Estate: Investing in property can provide rental income and potential capital appreciation.

- Retirement Accounts: These accounts, such as 401(k)s and IRAs, offer tax advantages and can be a significant component of your retirement savings.

Tips for Successful Investment Planning

- Start Early: The earlier you start investing, the more time your money has to grow.

- Seek Professional Advice: Consider consulting with a financial advisor to get personalized guidance and advice.

- Stay Informed: Stay updated on market trends, economic news, and investment strategies.

- Be Patient: Investing is a long-term endeavor. Avoid making impulsive decisions based on short-term market fluctuations.

- Review Your Plan Regularly: Life circumstances can change. Periodically review your investment plan to ensure it remains aligned with your goals.

By following these guidelines and developing a tailored investment plan, you can increase your chances of achieving your financial objectives and building a secure future.